Many people will be ready to resume vacations in the coming months. But, based on inquiries into travel insurance over the past year, we have learned from the pandemic.

According to Forbes Magazine, trip cancellation insurance purchases are at an all-time high. While it has always been a big seller, industry insiders state that they’ve never seen trip cancellation insurance plans sell at this level before.

If you’re itching to go on vacation, then trip insurance, in the form of trip cancellation or “cancel for any reason” policies are your best options.

But what are they? What are the differences between these two policies, and how do you decide which one is right for you? Read on to find out!

Trip Cancellation Insurance: What Is It?

Trip cancellation insurance is a protection policy purchased in case travel plans are canceled due to an unforeseen event. This type of insurance will reimburse you for vacation money spent, even non-refundable and forfeited costs. The details depend on the plan you purchase, but it generally covers costs up to your departure.

It’s often sold as optional insurance when you book tickets or hotels, but you can purchase it through travel insurance companies as a standalone policy as well.

What Does Trip Cancellation Cover?

Trip cancellation policies differ based on insurer and policy type. In general, they tend to cover costs such as:

- Unforeseen medical conditions or serious injuries that make you unable to travel

- The death of a person in the travel party or non-traveling family member

- Severe weather or strikes that make the provider unable to operate

- Natural disasters both at the destination or at your home that make them uninhabitable

- Legal obligations that interrupt your travel such as being served with a subpoena or jury duty

Some trip cancellation policies may also include trip interruption or trip delay benefits, so make sure to read the fine print carefully on any policy. You’ll want to understand what it does and does not cover.

When You Should Consider Trip Cancellation Insurance

There are several reasons why someone may be interested in buying trip cancellation insurance. Some of the most common reasons include:

Expensive Vacations

If you’ve been saving for a high-price trip, the last thing you want to do is cancel. But it’s a good idea to protect yourself against financial loss in case you do.

You’ve Planned Ahead

If you have made travel plans very far in advance of your travel date, then it’s a good idea to get cancellation insurance. You simply don’t know what situations may arise one, two, or even three years down the line. These unknown factors could impact your ability to travel.

You’re Taking a Cruise

Cruises are very difficult to cancel, and doing so can entangle you in a complicated process. Having trip cancellation insurance helps provide peace of mind that you’ll get your money back.

You’re Taking Kids

Kids get sick all the time, so protect yourself from sudden illness or last-minute cancellations due to childcare issues.

Cancel-For-Any-Reason Insurance: What Is It?

Cancel-for-any-reason (CFAR) insurance is a type of insurance that fills in the gaps of regular trip cancellation insurance. CFAR is an add-on insurance plan that allows you to cancel for any reason, basically covering concerns that trip cancellation insurance might miss.

How CFAR Works

In order to qualify for CFAR coverage, you have to insure 100 percent of your non-refundable and prepaid trip costs. You also must purchase the coverage within a certain number of days after your first payment for the trip. Typically, you buy the extra policy within 10 to 21 days after that initial payment. Some policies solely for cruises allow you to add CFAR up until the final payment, but, to be safe, you should check that this option exists right away.

Reasons to Consider CFAR Insurance

There are several reasons you may want to add CFAR insurance to cover your vacation. Certainly in the time of COVID, you may need to shelter your plans from illness or disease outbreaks. Some other reasons include:

- Fear of issues at your travel destination, such as terrorism

- Storms and hurricanes

- Changing your mind

That last one is probably one of the best reasons to get CFAR insurance. You simply don’t know how you’ll feel about going on a trip until it’s time to go. CFAR coverage allows you the freedom and space to change your mind.

About the Author:

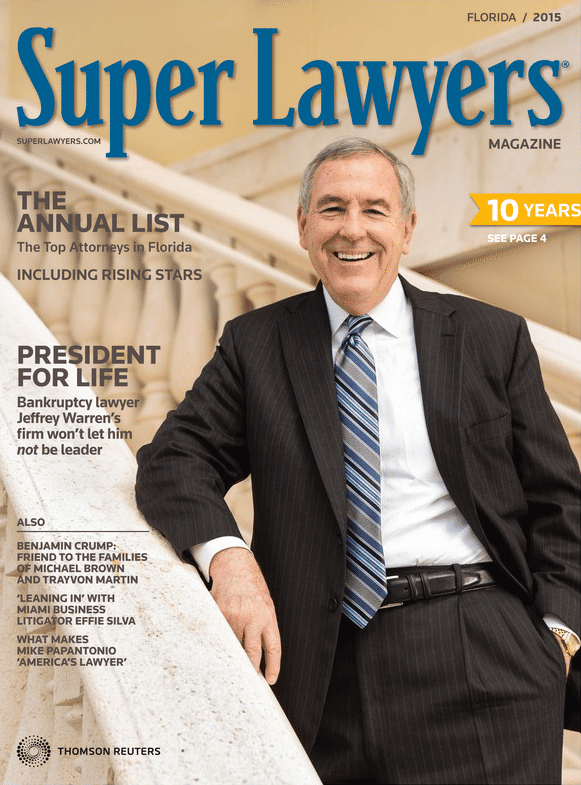

Andrew Winston is a partner at the personal injury law firm of Winston Law. For over 20 years, he has successfully represented countless people in all kinds of personal injury cases, with a particular focus on child injury, legal malpractice, and premises liability. He has been recognized for excellence in the representation of injured clients by admission to the Million Dollar Advocates Forum, is AV Preeminent Rated by the Martindale-Hubbell Law Directory, enjoys a 10.0 rating by AVVO as a Top Personal Injury Attorney, has been selected as a Florida “SuperLawyer” from 2011-2017 – an honor reserved for the top 5% of lawyers in the state – and was voted to Florida Trend’s ”Legal Elite” and as one of the Top 100 Lawyers in Florida and one of the Top 100 Lawyers in the Miami area for 2015, 2016, and 2017.